We’ve all had those emails. The one’s written in barely legible English letting us know about our great uncle we’ve never heard of that has no other living relatives and has left 2 million dollars if you just give them your bank account and personal details.

The most common types of scams in Australia are:

- Attempts to gain your personal information

- Buying or selling scams

- Fake charities & emergency scams

- Investment opportunity scams

- Jobs & employment scams

- Threats & extortion scams

- Unexpected money

- Competitions & unexpected winnings

- Dating & romance scams

- Business scams

While some scams are obvious, others are quite sophisticated and are becoming very hard to tell from the real thing. But there are a few tell tale signs for each of them you can be aware of.

Attempts to gain your personal information

There are many ways people will try to scam your personal information out of you. The most common are hacking, phishing, remote access scams and identity theft.

Hacking occurs when scammers use technology to gain your personal information from your computer, phone or tablet. This includes when are tricked into installing malware and ransomware on your device, which gives access to the hackers and they can access your information. This is made easier if you have easy to guess passwords, out of date anti-virus software or commonly use unsecured Wi-Fi or Bluetooth networks.

Remote access scams work by trying to convince you that you have a computer program and need to install software to fix it or give access to them remotely so they can fix the problem for you. They then have access to your device to steal information.

Phishing works by generally contacting you via email or over the phone pretending to be from a legitimate business. A common one is banks or telephone providers (as you are already conditioned to them needing your personal information). The scammer asks for you to provide or confirm you details. Phishing scams are designed to look genuine and so often copy the logos and branding. They may even take you to a copy website that looks very similar to the real thing but may have a slightly different web address.

Once a scammer has your information from one of the above methods (or through other methods such as stealing mail), it is easy to commit identity theft, and use your details to steal money or obtain benefits using your details. It is important to protect yourself from this and always verify anyone calling or emailing asking for personal details. You can also stop large scale identity theft by setting up alerts with a credit agency to let you know any time someone access your credit file – which will alert you to anything unauthorised.

According to the ACCC, this type of scam accounted for $1.5 million in losses in Australia during May 2020 alone.

Buying or selling scams

The rise of e-commerce and technology allowing people to buy and sell unwanted goods, scammers are also trying to get in on the act. If you are selling on a classifieds platform beware of scammers posing as genuine buyers. They will make up stories and usually ask you to pay for things like transportation of the item or insurance, which they ensure you they will pay you for. They will then pay you in a way that doesn’t work, leaving you out of pocket and them with the item.

A quick warning sign is asking you to email them rather than contacting each other through the classified’s site. They will then start their story in an email about why they can’t call / come and see the item etc.

If you are a buyer you may want to be wary of scammers posing as genuine sellers with fake ads, often copied from other genuine ads. In order to lure a number of victims in a hurry, the scammer advertises the item at a much lower price than comparable items advertised on the same site.

When you show interest in the item, the scammer may claim that they are travelling or have moved overseas and that an agent will deliver the goods following receipt of payment. Following payment you may receive a fake email receipt claiming to be from the website’s secure payment provider, however, you won’t receive the goods and will not be able to contact the seller.

Fake charities & emergency scams

This scam is particularly popular after emergency events, such as bushfires, cyclones and floods. Scammers impersonate actual charities and ask for donations or contact you claiming to be collecting money after natural disasters or major events.

Scammers will generally pose as genuine charities but can create their own charity name. Fake charities operate in a number of different ways. You may be approached on the street, at your front door by people collecting money, or via phone. Scammers can also set up fake websites which look similar to those operated by real charities.

Investment opportunity scams

Investment scams provide you with the opportunity to invest in something that is generally ‘low risk and high reward’. This can be via a cold call, hot tip on social media or website forums or through an investment seminar. The scammer may claim that they do not need an Australian Financial Services licence (top tip – anyone giving investment advice in Australia needs a licence), or that that they are approved by a real government regulator or affiliated with a genuine company.

The investments offered in these type of scams are usually share, mortgage, or real estate high-return schemes, options trading or foreign currency trading.

Jobs & employment scams

Most commonly, employment scams are advertised through emails, advertisements or through social networking. The job on offer may require you to do something simple such as stuffing envelopes or assembling a product using materials that you have to buy from the ‘employer’. When you pay the fee you will either not receive anything, or will receive a plan of how to get others involved in the same scam to earn money.

If you do receive something to make or do, on completion of your work, the scammer will refuse to pay you for some or all of your work, using excuses such as the work not being up to the required standard.

A lot of these scams target women looking to earn extra money. You can read more about how to spot work from home scams.

Threats & extortion scams

Scammers may hack your computer and install malware, which is software that allows them to access your files and track what you are doing, or ransomware, which ‘locks’ your computer unless you pay them money. Most of these scams occur through emails and social media messages with links or files attached. If you click on the link or download the file your device will be infected.

Threat scams work by someone contacting you about money that you supposedly owe and if you do not pay them you may be arrested etc. They are designed to frighten you into handing over your money and can even include threats on your life.

The most common scam of this type in Australia is people pretending to be the Australian Tax Office saying you have a tax debt and if you don’t pay it off you will be arrested. But they have been known to pretend to be other government agencies, banks or utility providers. A warning sign for this scam is that the scammers may not ask you to pay cash, but instead pay the debt in gift cards.

Unexpected money

These scams offer you thousands or even millions of dollars. Usually from a relative that’s passed away that you knew nothing about, or even just someone trying to transfer money and offering you a share. Scammers will go to great lengths to convince you that it is going to be a legitimate transaction.

You are usually asked to fill out forms (which gives scammers access to your personal information) and pay a fee (which you won’t see again) to process the money.

Competitions & unexpected winnings

Lottery scams work by asking you to pay a fee to claim a prize you’ve won from a lottery or competition you never entered. Scammers will often say these fees are for insurance costs, government taxes, bank fees or courier charges. You pay the fee and then never receive the prize.

Scratchie cards are sometimes used in promotions, lotteries or competitions, beckoning users to ‘scratch and win an instant prize’, for example travel or holidays. It is a scam if you win and instant prize but when contacting the company to receive it you will need to pay a fee for the prize or hand over banking or other details.

Dating & romance scams

Romance scams often take place through dating websites but can also occur through contact on social media. Scammers will typically have a fake profile that sounds great. They can use fake names or take on the identity of an actual person.

Scammer will go to great lengths to build your trust and once they have gained your trust and your defences are down, they will ask you (either subtly or directly) for money, gifts or your banking/credit card details, usually to help with a personal emergency or that they want to visit you but can’t afford it. They may send you goods and ask you to send them somewhere else or purchase goods and send them somewhere. They might even ask you to accept money into your account and send it on. These are all forms of money laundering.

Romance and dating scams can be run by international criminal networks and so can be very sophisticated. These types of scams cheat millions of dollars from Australian’s every year.

Business scams

There are a number of scams that seem to target businesses and can easily slip by you when you’re busy trying to run your business. Before you pay any bills that come randomly in your email, it pays to take some time to check that you actually owe the money. Here are some common business scams.

False billing scams request you or your business to pay fake invoices for directory listings, advertising, domain name renewals or office supplies that you did not order. An email may appear or someone may phone you asking for payment or to confirm a listing or product order. Many email-based ransomware scams use fake bills as attachments to infect your computer. If you receive an unexpected bill from someone, do not open the attachment.

Domain name renewal scams can work in a few ways. You may be sent an invoice to renew a domain name that is very similar to you actual domain name – hoping you’re busy and won’t notice the difference before paying. Another way is the sender may claim that another company is seeking to register the a domain name similar to yours, but they are giving you the brief opportunity to secure the name first. You will be told your chance to use the domain name will end if you do not pay immediately.

Payment redirection scams happen by hacking your computer systems or email and getting information on you suppliers. They then contact you pretending to be your supplier and letting you know their payment details have changed. They may even use copied letterhead and branding to convince you. They will then provide you with a new bank account number and ask that future payments are paid to that. The scam is often only detected when your regular supplier asks why they have not been paid.

Overpayment scams are when someone overpays you “by mistake” and then asks you to refund the difference via a different method of payment or to a different credit card. You will then find out that the credit card they originally used to pay you was stolen, or the cheque will bounce. It is also a popular way to launder money. If you send any money, you will not get it back. If you have already sent the ‘sold’ item, you will lose this as well. Only ever offer a refund of any money to the same card or payment method you received it.

Scammers often create websites offering information about government grants. All government grant information is free – you don’t need to pay to access the information as it is available on the relevant government website. Government websites will never ask you to pay money for access to government grant information – so be wary of any websites that offers grant-related services (such as providing information about the grant) in exchange for a fee.

Government grants are awarded based on merit – you can’t pay money for special access or consideration. It is possible to pay a third-party provider to help you with writing your grant application, however it’s important to choose a reputable service.

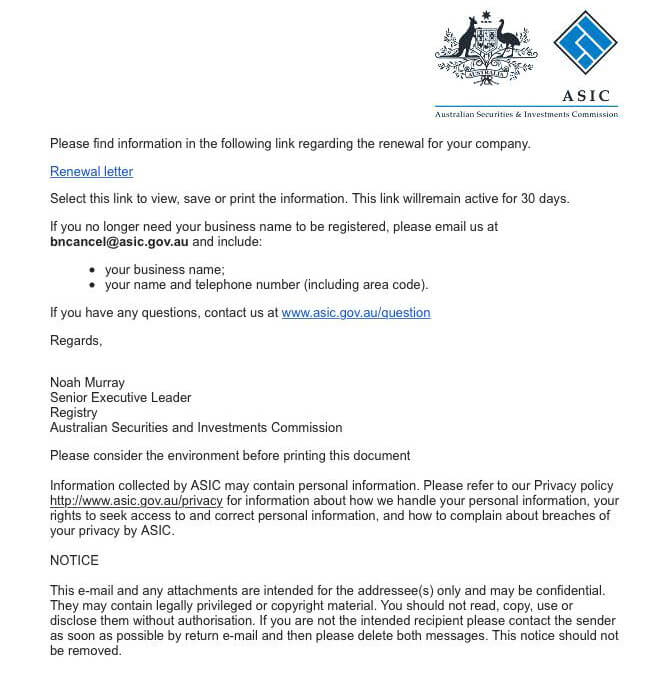

If you are a business owner, you would be aware of the yearly renewal fee emails you get from the Australian Securities and Investment Commission. However, scammers have recently been targeting business owners with fake renewal letters.

Scammers pretending to be from ASIC have been contacting businesses asking them to pay fees and give personal information to renew their business or company name. These emails often have a link that provides an invoice with fake payment details or infects your computer with malware if you click the link. Some emails look like the shown photo, and are a very good copy of actual ASIC renewals. Genuine ASIC emails will always have your name and business name.

If you are receiving something you don’t expect, or any email that seems a bit suspicious go with your gut and check it out further. Contact a company directly (not via any links on an email) to double check.

Some useful scam resources

ScamWatch (Australian Government)

Net Alert (Australian Government)

FIDO (Australian Securities & Investments Commission)

FraudWatch International (FraudWatch International Pty Ltd)

Crime Prevention & Community Safety (Attorney-General’s Office)

The Little Black Book of Scams: Your guide to scams, swindles, rorts and rip-offs