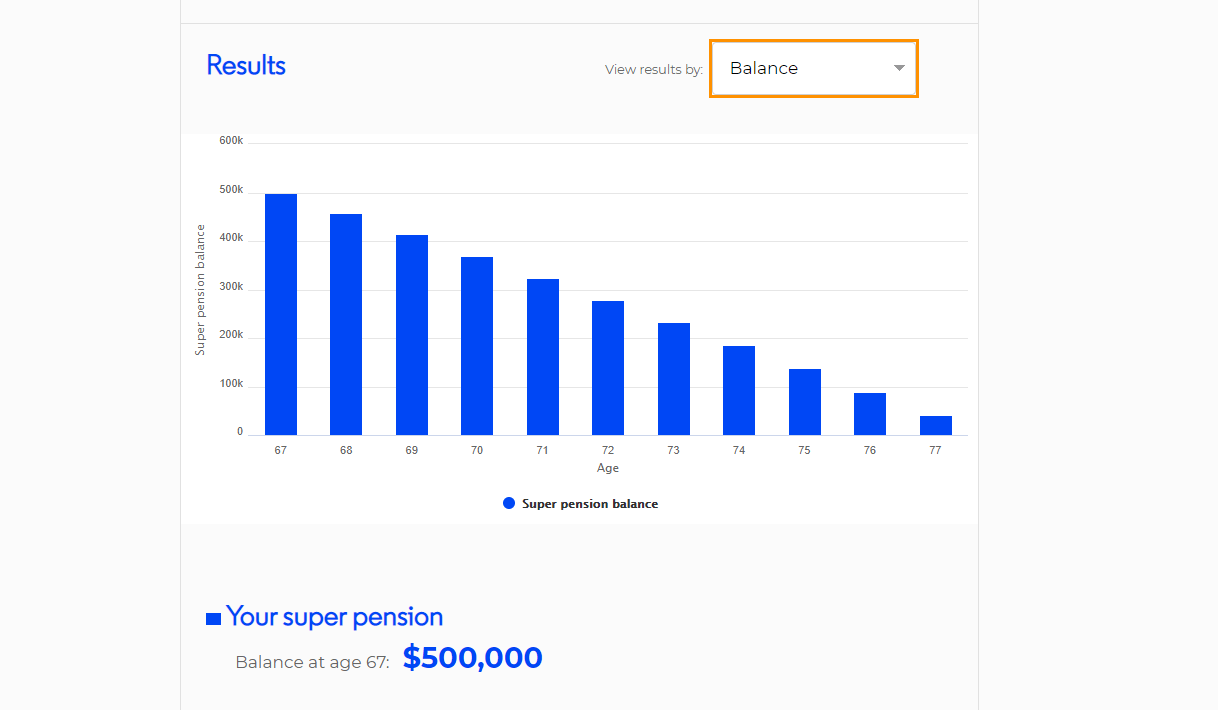

Did you know that if you retired today at 67 with $500,000 in your superannuation account and spent $50,000 per year on living expenses (the Australian average is actually $74,000), you would run out of money at 77 years old. That’s nearly 4 years before the average life expectancy if you’re a man and 8 years before it if you’re a female. Yikes.

Most people can expect to live into their eighties, so if you stop working in your mid to late sixties, you will need enough money in your superannuation and investments to survive for 20 years. Maybe even more. So, it pays to start thinking about how to save for your retirement to ensure you have enough money to survive comfortably.

Given people now in their thirties and forties might be retiring with a life expectancy into their nineties, Australians might need to explore other ways to boost their retirement nest egg.

Saving for your retirement

The rules of superannuation in Australia are complex and many. Which is why a lot of people tend to shy away from sorting out their super or thinking about what you need to do before retirement. But leaving your retirement plan to whatever superannuation company you have chosen can be risky, especially if you don’t monitor how much money you are expected to receive when you retire.

But super isn’t the only option you have for your retirement. There are many other things you can do to help ensure you have enough money to live comfortably well after your retirement age.

Look at financial investments

The stock market can be a scary and confusing place, but there are ways you can venture into it and help your retirement plan without having to be constantly watching the market and picking stocks.

Managed funds are when a number of investors pool their money together to enable them to invest in various assets. This fund is invested and controlled by a professional investment manager. When you invest in a managed fund you are given a number of ‘units’ of the fund depending on how much you invested. These units will go up and down in value depending on the total performance of the managed fund.

Managed funds offer you an opportunity to invest in assets such as stocks on the stock market without having to really know the ins and outs of how it all works. The fund is managed by a professional who should have access to knowledge, experience, information and research on the assets they are investing in, making it a less stress option for the individual investor.

Managed funds also make it easier to diversify your portfolio of investments. As the fund is pooling money together from many investors, they are able to purchase many assets that wouldn’t be available or affordable to the regular single investor.

Managed funds can cover a variety of assets including cash management trusts, property, shares, film schemes, agribusiness schemes and many more. It pays to do your research and look at the performance of the manager or fund before you invest.

Pay off your mortgage ASAP

The mortgage on your house is generally the biggest single living expense most people have. Therefore you really want to make sure that you no longer have a mortgage when you retire. Not only that, but being mortgage free early frees up a whole lot of cash that you can use in your day to day life or to charge up your retirement savings.

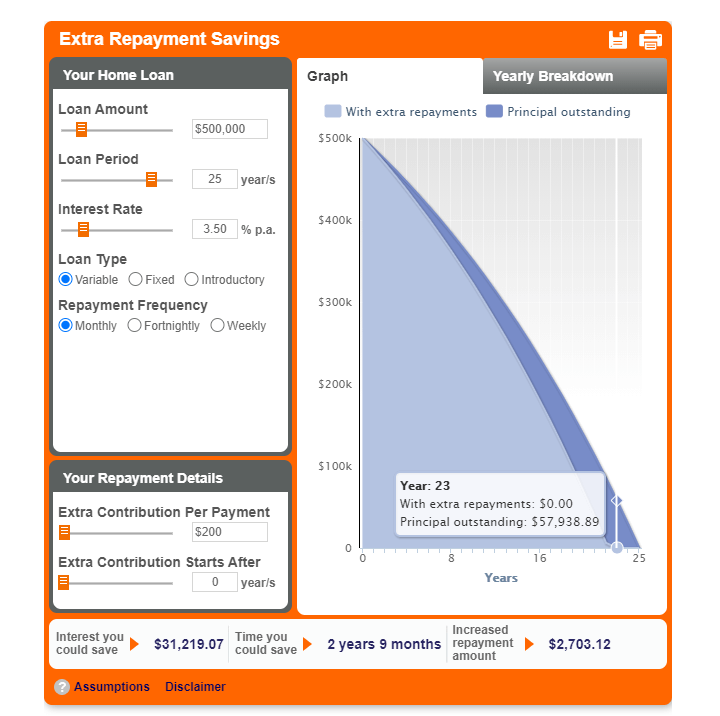

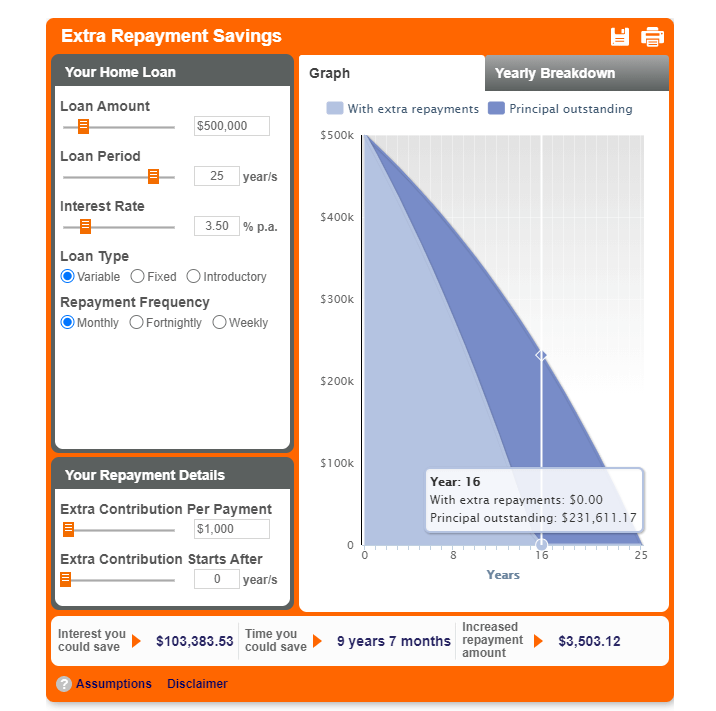

With interest rates at their lowest point ever, right now is a fantastic time to put as much into your mortgage as possible. If you had a home loan of $500,000 at 3.5% interest over 25 years, you would pay over $150,000 in interest over the life of the loan. That’s a lot of money.

But if you were able to pay just $200 extra in repayments per month, you could reduce the time it takes you to pay of the mortgage but nearly 3 years and save over $31,000 in interest. If you could manage to pay an extra $1000 per month over your repayment, you’d have the loan paid off 9 and a half years early and save a whopping $100,000 in interest payments.

Obviously, these amount vary wildly depending on your interest rates at the time, but this quick (and very simplified) example shows how much better off you can be if you can add a bit of extra money into your mortgage each month.

And if you are worried about the fact that once the money is in your home loan you can no longer access it, then get a loan with an offset function and put as much money as you can into that. An offset has the effect of reducing your interest repayments each month (depending on how much money is in the offset account), while still giving you access to the money if needed.

Open a high interest savings account

Granted, this isn’t a great strategy when interest rates are at all time lows, but if you want a way to access your money easily in case of emergency while still saving for retirement this could be a way to go. Look around for the best deals and look carefully at interest rates, as the highest interest can usually be found if you are depositing money only and not withdrawing.

If you are serious about increasing your retirement fund, then you can probably afford to deposit a small amount of your pay into a high interest savings account. Choose an option with no fees that pays interest on a monthly basis and the compound interest accumulation will grow significantly over time.

Be sure to add any extra funds such as tax returns and annual bonuses to your savings account as well. The short-term loss to your everyday income might be hard to swallow at first, but you will be rewarded for a long-term outlook with sizeable retirement savings.

Also, remember the earlier in life you open up a high interest savings account the more benefit you will receive with an advantageous future position.

Sacrifice some salary to increase your superannuation

Along with, or instead of, a high interest savings account, you could always sacrifice more salary to boost your superannuation. If you work full-time, your employer will already be contributing a percentage of your salary, but you can salary sacrifice more money into your super before tax, or add to it directly after tax.

You can organise with your employer to salary sacrifice super contributions from your pay before tax is taken out. These contributions will be taxed at a rate of 15% rather than your marginal tax rate so can be a cost-effective solution for adding more money into your superannuation account. However, these contributions will be added to the amount your employer has contributed and be counted towards your concessional contributions cap, which means the amount that your employer contributes and your salary sacrifice contributions added together cannot exceed $25,000 per year.

The other option to add to your superannuation account is by putting in personal contributions. This is money you contribute after tax has already been taken out. This is considered a non-concessional contribution. The amount you can put in depends on your circumstances but is generally up to $100,000 per year.

You can find more information about contributing extra money into your super by heading to the ATO website.

Look for rewards programs

You spend a lot on shopping. Groceries, clothes, birthday presents for the 100 birthday parties your kids get invited to. So why not use it to your advantage by finding a program that rewards your shopping and puts it towards your super. Programs like Super Rewards put a percentage of what you spend shopping online straight into your super account. This is a great way to add into your super without actually spending anything extra than what you would normally do.

You just need to sign up for an account and then go through their links to the various retailers that they have available. There’s over 300 retailers on their program including Best and Less, The Good Guys and even Woolworths. There’s even a chrome extension available so you never miss a chance to get rewards. With an average of 5% cashback into your super that’s a lot you could be contributing without having to do very much. It’s a great way to super charge your super.

Retirement might seem a long way off for you right now, but life moves so quickly. If you can plan how you are going to save for your retirement now it doesn’t matter what age you are now, you will be better off in the future.

Disclaimer

This information is general advice and does not take account of the individual’s objectives, financial situation or needs. Before acting on this general advice, individuals should therefore consider the appropriateness of the advice having regard to their objectives, financial situation or needs. The content of this website has been prepared for informational purposes only and is not intended to amount to financial product advice or a recommendation.

Sources for data:

Moneysmart Pension Calculator

The World Bank Life Expectancy Australia

Moneysmart Australian Spending Habits

ING Home Loan Calculators