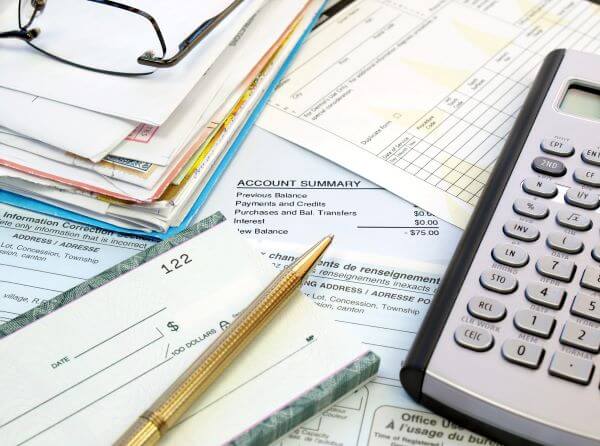

If you have ever worked as a bookkeeper or in some similar capacity, you can work at home keeping the books for local or online businesses. This is an ideal position for the work at home mum who wants to make a nice income but who wants to work exclusively at home.

To become a successful work at home bookkeeper in Australia you will need to:

- Have a qualification in bookkeeping and accounting to be able to register as a BAS agent.

- Get an ABN as it is more likely that you will set yourself up to become a contracted bookkeeper rather than an employee.

- Get Insurance for professional indemnity.

- Set up your workplace.

- Create a website.

- Set your fees.

- Find some clients.

Contract bookkeepers are usually self-employed, running their own small business, who provide bookkeeping services to other businesses. It is easy to operate out of your own home and provide remote/online services for your clients if you are set up correctly.

Steps to Become a Work at Home Bookkeeper

Bookkeeping services can be many and varied. You can be doing things like recording transactions, invoicing and purchasing, bank reconciliations, maintaining payroll systems, keeping inventory and asset records, maintaining financial records for tax purposes and preparing and lodging Business Activity Statements (BAS).

If you enjoy number, databased, spreadsheets and reports, then a career as a work at home bookkeeper may be for you.

Step 1: Check your qualifications

You don’t need formal qualifications for most bookkeeping skills, if you have the experience. However, if you want to offer BAS services such as preparing business activity statements, setting up computerised accounts with GST or consulting on BAS issues you will need to be registered with the Tax Practitioners Board as a BAS agent. This requires you to have a minimum of Certificate IV in accounting or bookkeeping which includes a course on GST/BAS and professional experience.

You are not allowed to complete Business Activity Statements or offer some other tax services for a fee if you are not registered as a BAS agent. You don’t strictly need to offer BAS services to be a bookkeeper, but you can offer a more well-rounded and complete bookkeeping service to people if you do have it.

Step 2: Get an Australian Business Number (ABN)

To offer your services to different clients, rather than being hired by one employer, you’ll need to set yourself up as a business. This can be done as a sole trader, but you will still need an ABN. To help you along take a look at setting up a business for a bit of guidance in getting started.

Step 3: Sort out your insurance

If you are going to be working as a work from home bookkeeper you will need to organise professional indemnity insurance. This insurance covers you for losses suffered by your clients or other third parties due to mistakes or errors. It should also pay the legal costs of defending a legal case if a client makes one against you. It is not only good common sense, but is also a requirement of becoming a BAS agent.

Step 4: Set up your workspace

The beauty of a bookkeeping practice is it is easier than ever to run from your own home. Some clients might ask to meet face to face but a lot can be done over the phone, email or programs like Skype. It’s important to set yourself up somewhere in your home where you can be undisturbed and have everything you need around you. A dedicated office space is great for this and it’s good to have it organised for your needs.

Most bookkeeping these days is done on computers. This also allows you to work with client accounts remotely rather than in their offices. It’s much easier to manage financial records and produce accounting reports in this way. You will need a good reliable computer and knowledge of the most popular accounting software packages such as Xero, MYOB etc. Most of the programs run education courses for accountants and bookkeepers if you think you are lacking some skills or want to really specialise.

Step 5: Set your rates and charges

Working out what price to charge is one of the hardest, yet most important parts of your work from home journey. Look at how many clients you could comfortably handle at one time. Are you going to be charging per hour of work of are there some clients that will pay a retainer each month for bookkeeping work?

When you’re working for yourself, you need to make sure you are covering all your overheads and expenses. Think about things like your equipment, internet, website costs, a wage for yourself, superannuation and taxes. You don’t want to do all that work and find out you’re out of pocket at the end of the month.

Step 6: Create a website

You may think, “I’m a bookkeeper, why do I need a website?” But unless you have a great network and are going to get a bunch of word of mouth referrals, the first place people will look to research for a bookkeeper is Google. To this end it is a good idea to have a website in place showcasing the services you have to offer.

If you’re unsure how to but want to create a website then have a look at our How to Build Your Work at Home Website course which will teach you how to create a website yourself, saving you a bundle in website developer fees.

Step 7: Get some clients

Going out on your own can be a scary prospect as you’ll need some paying clients. You may need to learn to promote yourself to become successful. This comes naturally to some but not for others. A good way to meet prospective clients can be to attend events and conferences to start. Small business events are normally great as a lot of small businesses don’t have the money to employ full time accountants or bookkeepers but need some help. There is some truth in the saying “It’s not what you know, it’s who you know.” If you are already in the industry and are liked and respected by colleagues, ex colleagues, clients, friends – let them know you are going freelance and get them to help spread the word. Word of mouth and testimonials from client can be a big driver for getting new business as it creates trust and credibility about your services.

Step 8: Scale up – or don’t

The beauty of running your own business as a bookkeeper is that you can control how much work you do (to an extent). If you find yourself with too much work, you don’t have to accept anything new. If you have more time available, then you can offer it up to existing or new clients.

It’s important to make sure you are setting a schedule and that clients know when you are and aren’t available for enquiries and to solve their problems. This creates boundaries and allows for a much more harmonious relationship between you and your clients. Small business owners tend to work all hours but just because they send you an email at 11pm doesn’t mean you need to answer it.

Freelance Bookkeeper Vs Employed Bookkeeper

Freelance bookkeeping can be a rewarding career, especially as it gives you more freedom to do things like work from home, however some people prefer the security of being employed. Employed bookkeeprs aren’t required by law to be qualified or be a BAS agent.

Getting employment as a bookkeeper is a great way to gain experience in bookkeeping. It is especially good for those starting out in the industry as it gives you a chance to develop your skills and can be a great steppingstone for eventually going out on your own. To get a job as a bookkeeper, employers will most likely still like you to have some qualifications. If those qualifications also include a course on GST/BAS then they can be used towards registering as a BAS agent at a later date.